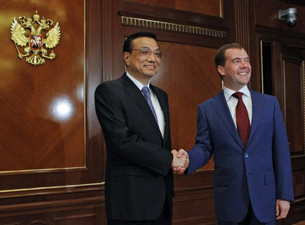

China has reported big trade deals with Russia following the visit of Vice Premier Li Keqiang, but there has been no apparent break in a six-year standoff over gas supplies, experts say.

During his visit on April 26-30, Li announced that the two countries had signed 27 contracts valued at U.S. $15 billion, the official Xinhua news agency said.

While the Chinese side provided few details, the total includes a planned U.S. $4-billion joint investment fund to be launched in June by state-owned China Investment Corp. and the Russia Direct Investment Fund.

The pool will back industries including machine building, agriculture and timber with special attention to energy efficiency and supply, Interfax reported.

Other deals include investment in rubber production, mining, and electricity supplies to China, Russian news agencies said.

But far less progress was reported on finalizing a deal for Russian natural gas exports, which has been pending since 2006.

Officials on both sides said there were still disagreements on the price that China would pay for up to 68 billion cubic meters (2.4 trillion cubic feet) of gas per year.

"Now all that remains is the question of prices," said National Energy Administration (NEA) director Liu Tienan, according to Reuters. Russian and Chinese officials have been making similar statements for several years.

New model?

Despite an initial agreement in 2006, the two countries have been at odds over Gazprom's insistence that its shipments to China should earn as much as its exports to Europe.

China has argued that its citizens and industries can't afford to pay European rates. China National Petroleum Corp. (CNPC) is already losing money on its gas imports from Turkmenistan, which it sells at state-controlled prices.

Li, who is expected to become China's next premier, tried to break the impasse with Russia by presenting "a completely new model" for gas cooperation, Liu told Reuters, but officials did not disclose the details.

Edward Chow, senior fellow in the energy and national security program at the Center for Strategic and International Studies in Washington, said the new model is likely to include "upstream" investment for access to Russian gas fields.

Chow told RFA that such investment in East Siberia would "allow the Chinese to invest and moderate the pricing demand just as they have done in Turkmenistan." But Gazprom has resisted such approaches in the past.

Ongoing dispute

Differences between the two countries have long bedeviled expectations that Russia's massive resources would make it the leading supplier for neighboring China's huge energy demand.

After years of delays, Russia opened its first oil pipeline to China at the start of 2011, only to become bogged down in a pricing dispute over deliveries.

Last year, Russia ranked fourth among China's oil sources, accounting for 7.7 percent of its imports, according to customs data. The countries have yet to build a gas pipeline.

Instead, CNPC has invested billions in opening gas routes from Central Asia, where it has access to gas field development and greater influence over pricing and supplies.

Russia has outlined plans for Siberian pipelines to enter China from both the east and the west, but it has insisted on building the western line first, creating another fundamental disagreement.

China's biggest gas markets are in the east, and it already has enough pipelines and resources in the west.

The problem is that Russia not only wants European prices, but it wants to charge them at its border with Xinjiang, said Mikkal Herberg, research director for energy security at the Seattle-based National Bureau of Asian Research.

"By the time you transport that all the way to China's east coast where the market is, that gas at European prices is as expensive as liquid natural gas (LNG)," Herberg said in an interview.

Herberg said China might pay the prices at the eastern border, which is closer to its biggest markets, but Russia has been stuck on building the western route for its own development reasons.

"Until Russia comes around on which pipeline proposal and source that goes to eastern China, it's going to be very difficult to sign a deal," he said.

European market

While the issue of parity pricing with Europe is an old one, the new wrinkle is that Gazprom is also under increasing pressure to lower its prices there.

The Russian monopoly has relied for years on long-term contracts with gas prices keyed to oil costs. But European customers have been demanding bigger breaks to reflect spot market gas prices as world supplies rise.

Growing production of shale gas in the United States has reduced LNG demand and driven cargoes to other markets. As a result, Russia seems to be pushing China to accept Europe's prices when it is clinging to rates there that may be artificially high.

"They are under a lot of pressure in Europe to lower gas prices," said Herberg. "The Chinese are perfectly well aware of this at the same time."

As a result, the big gas deal between Russia and China may not be closer but further away, unless Moscow is ready make major concessions in both Europe and Asia.

"I think from the Chinese point of view, they believe time's on their side on the pricing issue," said Chow. "There's no particular reason to come to terms with the Russians on a number that they deem unfavorable to them."