After a decade of challenges, China has opened its first oil pipeline from Russia, but experts question whether the link marks the start of a long-awaited energy partnership between the two powers.

On Jan. 1, China received its first commercial delivery of oil through the 990-kilometer (615-mile) line to its northeast oil capital of Daqing, news services said.

Crude oil from Siberia is now flowing at the rate of 42,000 tons (307,000 barrels) per day, according to the official Xinhua news agency.

The pipeline will allow Russia to effectively double its oil exports to China, Reuters reported.

But analysts voiced doubts that it will.

For years, strategists have seen the potential for joining Russia, as the world's top oil producer, with China, the largest energy consumer. But hurdles have always hindered closer ties between energy sources and markets next door.

The pipeline has again raised expectations of a big breakout in Russian oil and gas sales to China.

"Problematic"

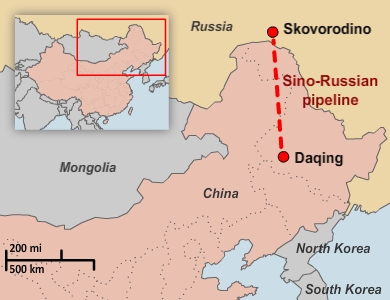

Map shows the location of the Sino-Russian pipeline

RFA

But Stephen Blank, professor of national security studies at the U.S. Army War College, said predictions of huge growth are still problematic.

"It's a lot overblown," said Blank. "There's a lot of inflated talk here that distorts the reality."

Despite its closeness to China, Russia has supplied only about 6 percent of the country's oil imports over the past year, with most deliveries moving by rail.

Blank believes that much of the new pipeline's volume will be taken from rail transport to save costs rather than doubling China's sourcing from Russia.

"I don't know that it will double Chinese imports," said Blank. "It's certainly cheaper."

Despite the arguments for energy partnership, the two countries have struggled for years to open a pipeline connection.

Long delaysFormer President Jiang Zemin first reached agreement on the project at a Moscow summit with then-President Vladimir Putin in 2001.

Long delays followed while Russian officials debated whether to build a pipeline to China or to the Pacific Coast for the Japanese market amid suspicions that Beijing would try to dictate prices if it became the sole buyer on the route.

In the end, Russia decided on a two-stage project for the massive 4,800-kilometer East Siberia-Pacific Coast (ESPO) pipeline with a branch crossing the Amur River to Mohe County in China's northeast Heilongjiang Province. The second-stage to the Pacific is scheduled to open in 2013.

But the decision came only after China agreed to provide $25 billion in loans to Russia's state oil and pipeline companies against future deliveries.

More trouble followed when the Russian pipeline monopoly Transneft failed to find contractors who would finish the work in the harsh Siberian conditions. Reluctantly, the company allowed Chinese crews on Russian territory instead.

Cold war suspicionsWhile energy needs have driven cooperation between Russia and China, lingering Cold War suspicions continue to haunt progress and growth.

"For both of them, energy policy is tied hip-to-hip with their foreign policy, and increasingly on their foreign policy, they view each other with immense suspicion in this part of the world," said Alexandros Petersen, non-resident senior fellow at the Atlantic Council in Washington.

Perhaps as a result, the outcome of energy cooperation between the two neighbors has never lived up to its promise.

Even as China's oil imports soared nearly 20 percent last year, Russia ranked fifth among its suppliers with a slight decline through the first 11 months. Imports from Russia were about a third of those from distant Saudi Arabia.

Although the opening of the oil pipeline could be a breakthrough, a similar process for Russian gas sales has been dragging on for years.

Russia is the world's leading gas exporter, while China is the fastest-growing market. But after five years of talks, the two sides have failed to agree on an import price.

CompetitionRussia's Gazprom believes it will strike a gas deal this year. But in the meantime, China has invested billions to build its Central Asia Gas Pipeline from Turkmenistan through Uzbekistan and Kazakhstan, essentially moving into Russia's backyard.

"The big story of cooperation between Russia and China has been replaced by the story of their outright competition for resource control among the countries of Eurasia," said Petersen.

Whether energy cooperation will increase along with competition remains an open question.

Stephen Blank said China has been diversifying its supplies of imported gas as it has already done with oil, leaving less of a role for Russia to play despite its export potential.

"They really don't need to buy a lot of gas from Russia," he said.